modified business tax id nevada

Web Comply with our easy steps to have your Nevada Modified Business Tax Form 2020 ready quickly. Web What is Nevada modified business tax used for.

Nevada Business Registration Online 2014 Form Fill Out Sign Online Dochub

The MBT is imposed at a rate of 011.

. Gross wages payments made and individual. Every employer who is subject to Nevada Unemployment Compensation Law NRS 612 is also subject to the Modified. Web Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business.

What is the Modified Business Tax. Total gross wages are the total amount of all gross. General Business General business is considered as.

The modified business tax covers total gross wages less employee. Web The Nevada Modified Business Return is an easy form to complete. Web Follow the step-by-step instructions below to design your nevada modified tax return.

Web Overview of Modified Business Tax. However you may owe a modified business tax MBT rate of 117 percent if taxable wages exceed 62500 in a quarter. General Business The tax rate for most General Business employers as opposed to Financial Institutions is.

Web Modified Business Tax has two classifications. Web In Nevada there is no state-level corporate income tax. Web Modified Business Tax Statistics Please note the following figures are based on tax-paying businesses only and are not a complete representation of total Nevada gross wages.

Web The easiest way to manage your business tax filings with the Nevada Department of Taxation. Web The modified business tax covers total gross wages less employee health care benefits paid by the employer. Select the document you want to sign and click Upload.

Web Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial. Choose the web sample from the catalogue. Web Add Your Nevada Payroll Account Numbers to Square Payroll You must provide a valid Nevada Account Number and Modified Business Tax MBT Account Number to sign.

Web The Tax IDentification number TID is the permit number issued by the Department. It requires data and information you should have on-hand. Log In or Sign Up to get started with managing your business.

Web MBT or Modified Business Tax is a type of Nevada commerce tax that is applicable to two types of categories and they are. Web The Nevada Modified Business Tax MBT is a tax on businesses with gross revenues of more than 4 million per year. Searching the TID will list the specific taxpayer being researched with its affiliated.

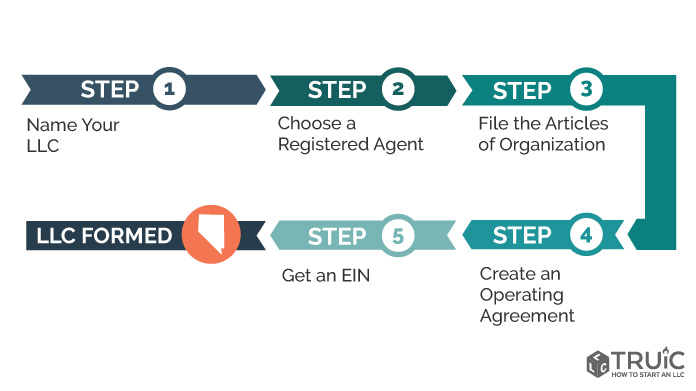

Nevada Llc How To Start An Llc In Nevada Truic

With Faster Than Expected Recovery Nevada Projected To Have 586 Million More To Spend In Next Two Years The Nevada Independent

Marginal Tax Rates For Pass Through Businesses Vary By State

Marginal Tax Rates For Pass Through Businesses Vary By State

How To Form A Nevada Professional Corporation In 2022

How To File And Pay Sales Tax In Nevada Taxvalet

Nevada Llc How To Start An Llc In Nevada

2022 State Income Tax Rankings Tax Foundation

Sisolak Under Fire For Job Killing Taxes In New Ad By Gop Governors Linked Group The Nevada Independent

Judge Sides With State Senate Gop In Lawsuit Challenging Extended Payroll Dmv Taxes The Nevada Independent

Modified Business Tax Form Fill Out Printable Pdf Forms Online

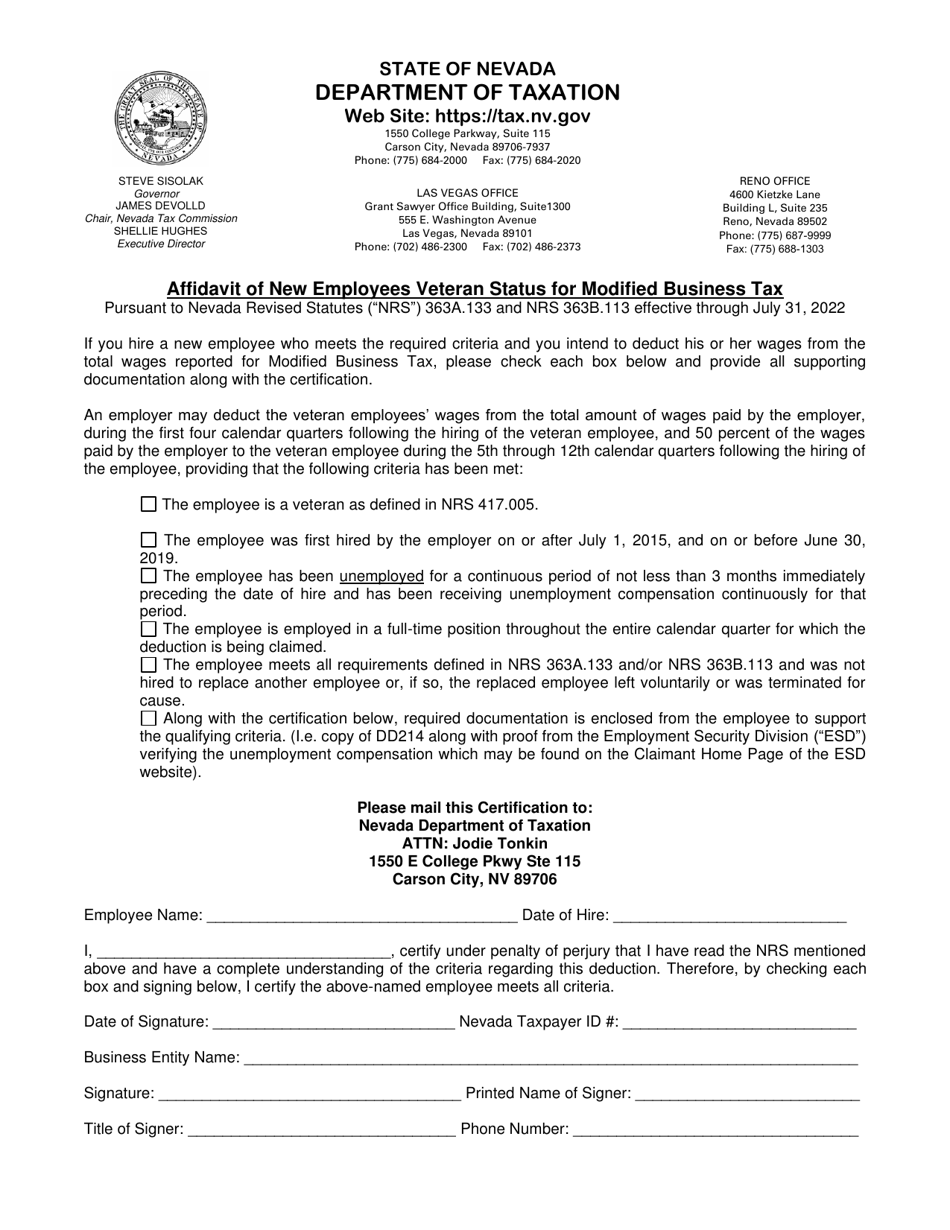

Nevada Affidavit Of New Employees Veteran Status For Modified Business Tax Download Fillable Pdf Templateroller

How To Form An Llc In Nevada Llc Filing Nv Swyft Filings